Motor expense vs Mileage expense

Knowing the difference between motor expenses and mileage expenses could result in thousands of euros in your pocket.

The majority of business owners are unaware of the difference between motor expenses and mileage expenses. It’s an issue that affects thousands of businesses and applying the correct claim for your business can result in thousands of euros off your tax liability.

So whats the difference?

The decision to pick motor or mileage expenses depends on a few factors. If the vehicle in question is property of the company, then the individual driving cannot claim mileage expenses as they did not incur the cost of purchasing the vehicle. The reason we have two different ways of claiming expenses, is to cover two very different scenarios.

Motor Expenses

If the business owns and maintains the vehicle, it stands to reason that the individual driving it would not claim expenses for the miles covered as they do not incur the costs associated with the vehicle and are paid for their time driving through payroll. In this situation the costs associated with the vehicle such as fuel, tyres or servicing can be claimed under motor expenses. Keeping records of those expenses through collecting receipts can be problematic as they are easily lost or damaged. Many companies tackle this issue by setting up expense accounts with local garages and using fuel cards to both monitor fuel consumption and track their allowable expenses. If you or your SME has not been tracking their allowable expenses they are likely missing out on thousands of euros of tax relief that accurate recording of motor expenses can provide.

Mileage Expenses

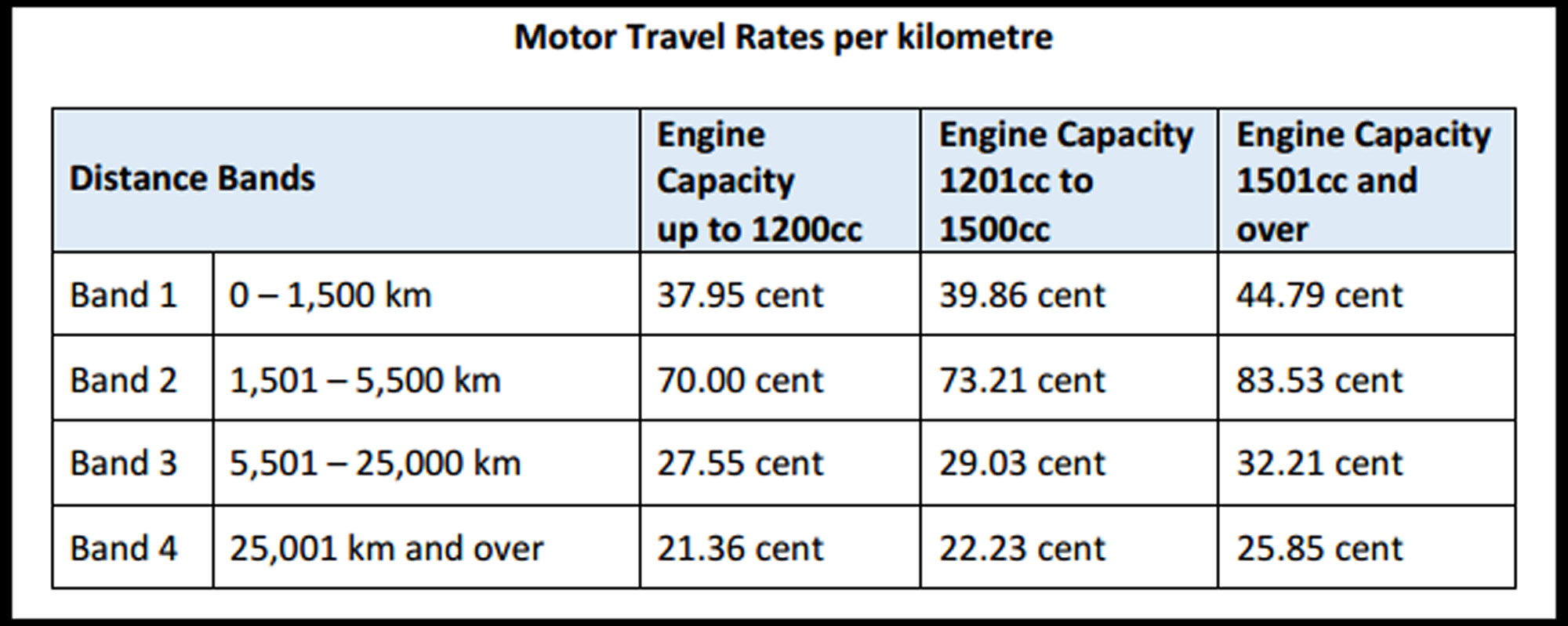

Mileage expenses will typically apply when an individual opts to use their personal vehicle for work purposes. It is at the discretion of the car owner if they decide to use their personal vehicle for work so they are entitled to claim an agreed amount per kilometer. The amount agreed is at the discretion of the employer, however they are required to keep payments at or below the accepted rates per kilometer that are available to civil servants.

The graph below details the allowable rates per kilometer for civil servants. It is acceptable for employers to agree a lower rate for travel expenses however they are not allowed to reimburse at a higher rate than the current civil servants allowance.

For more information please contact our Carlow based office on 059 9145992 or email info@taxpro.ie

Visit the Revenue website for up to date information on the allowable rates and further information.